Rising Risk in the Red Sea?

Geopolitical tensions and attacks in the Red Sea have increased since the start of the Israel-Hamas conflict. In the wake of this conflict, merchant shipping was affected by missile…

mehr lesenRead our Seafreight Insights to find out about the latest developments in the global sea cargo industry. Get an update on trade and rate developments as well as flexible solutions offered by cargo-partner to deal with the current challenges.

The seafreight market in 2025 was characterized by high volatility and geopolitical instability, driven in particular by the Red Sea crisis and US trade tariffs. These factors caused major disruptions in terms of trade patterns and freight rates. With political tensions expected to persist, the market is likely to remain challenging.

Key market dynamics and trends include:

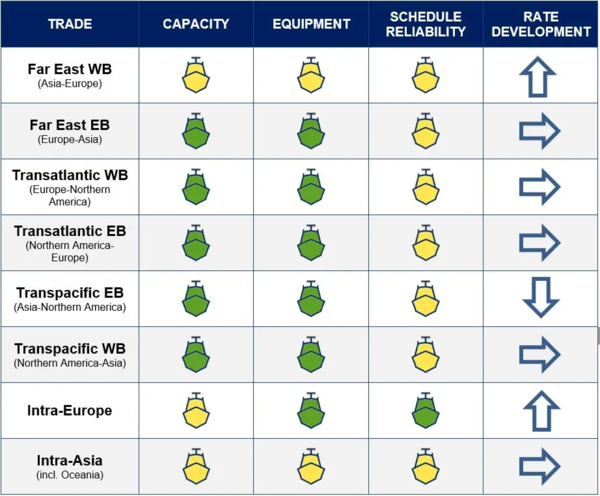

Legend: traffic lights showing current status, arrow indicates possible development of transport rates.